Prices Paid to Hospitals by Private Health Plans Are High Relative to Medicare and Vary Widely: Findings from an Employer-Led Transparency Initiative

Published in May 2019 as the second in a series of Employer Price Transparency Studies, the RAND 2.0 report assessed $13 billion in hospital spending in terms of hospital price levels, variation, and trends from 2015 through 2017 across 25 states. Large price discrepancies existed between what private health plans paid for hospital services and what Medicare paid. RAND Corporation researchers used data from three sources—self-insured employers, state-based all-payer claims databases, and health plans.

In this report, prices reflect the negotiated allowed amount paid per service, including amounts from both the health plan and the patient, with adjustments for the intensity of services provided. These negotiated prices were then compared with Medicare reimbursement rates for the same procedures and facilities to determine relative prices. This is the first broad-based study that reports prices paid by private health plans to hospitals identified by name and to groups of hospitals under joint ownership—hospital systems—identified by name.

Demographics

12.9

Billion dollars in hospital spending

1,598

Hospitals

25

States

Study Results: Commercial Prices Paid

Relative to Medicare Prices in 2017

204%

In-patient hospital average

(facility only)

Indiana average: 236%

293%

Out-patient hospital average

(facility only)

Indiana average: 403%

241%

In-patient & Out-patient hospital average (facility only)

Indiana average: 311%

Study Summary

The study suggested that employers can exert pressure on their health plans and hospitals to shift from discounted charge contracts to contracts based on a multiple of Medicare or some other prospective case rates. Using their networks and benefit designs, employers were encouraged to move patient volume away from high-priced, low-value hospitals and hospital systems.

Employers can encourage expanded price transparency by participating in existing state-based all-payer claims databases and promoting development of new ones. While transparency by itself is insufficient to reduce hospital prices, transparency is useful in making smarter decisions and in collaborating with policymakers at the state or federal level.

Key Findings

Relative prices, including all hospitals and states in the analysis, rose from 236 percent of Medicare rates in 2015 to 241 percent of Medicare rates in 2017

- Some states like Michigan, Pennsylvania, New York, and Kentucky had relative prices in the range of 150 to 200% of Medicare rates; other states like Colorado, Montana, Wisconsin, Maine, Wyoming, and Indiana had relative prices in the range of 250 to 350% of Medicare rates.

- Relative prices increased rapidly from 2015 to 2017 in Colorado and Indiana, but they fell over the same period in Michigan.

- Among hospital systems, prices varied nearly threefold, ranging from 150 percent of Medicare rates at the low end to 400-plus% at the high end.

Relative prices for hospital outpatient services were 293% of Medicare rates on average, far higher than the average relative price for inpatient care

- Notably, eight states—Michigan, New York, Tennessee, Massachusetts, Louisiana, New Hampshire, Montana, and Maine—stood out as exceptions to this general finding, with relative prices that are roughly equal for inpatient and outpatient service.

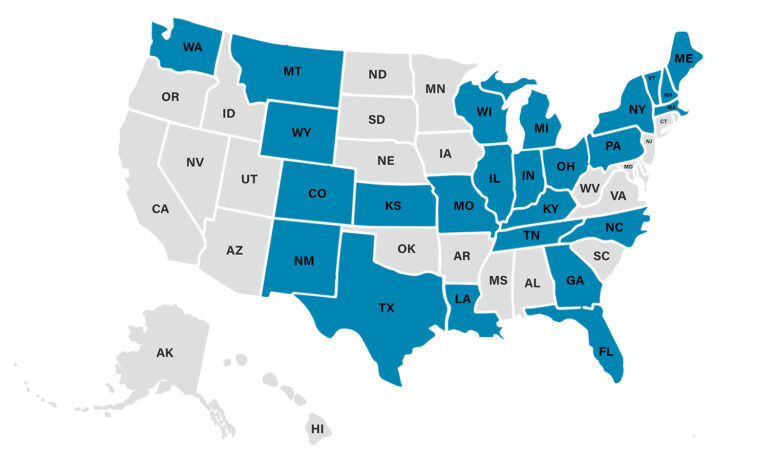

Interactive Price Map (RAND 2.0)

Using data from 2015 through 2017, this interactive price map allows users to see the overall relative price metric from each hospital with sufficient claims in the RAND 2.0 study. This data was published in May 2019 and is most useful now for historical comparison. For more up-to-date information, visit Sage Transparency.

Having problems? This map is hard to navigate with touchscreen and is therefore best viewed on your desktop.

UPDATED May 17, 2019

Additional Resources

Dive deeper into the RAND 2.0 study with additional resources, including presentation materials from the 2019 National Hospital Price Transparency Conference.

Press Release

Read the press release from the RAND Corporation and Employers’ Forum of Indiana.

Using RAND 2.0 to Achieve High Value

Slide deck from a presentation on RAND 2.0 by Gloria Sachdev.

All 2019 Conference Presentations

Browse all slide decks and videos from the 2019 National Hospital Price Transparency Conference.

In the News: Forbes

Read coverage of the RAND 2.0 report by Forbes expert Avik Roy.

Authors

Chapin White

Deputy Director of the Health, Retirement, and Long-Term Analysis Division at the Congressional Budget Office

While at RAND Corporation, Chapin White (Ph.D., Harvard University, ‘05), was the lead researcher on the first two Employer Price Transparency Studies (RAND 1.0 and 2.0). As a Senior Policy Researcher at RAND, he led the development of RAND’s Health Care Payment and Delivery Simulation Model (PADSIM), which was used to analyze state-based options for reforms in health financing in Oregon and New York, and he led an analysis for the Assistant Secretary for Planning and Evaluation (ASPE) of the spillover effects of Accountable Care Organizations (ACOs) on the Medicare fee-for-service program. Chapin is currently the deputy director of the Health, Retirement, and Long-Term Analysis Division at the Congressional Budget Office.

Christopher Whaley

Associate Professor in the Department of Health Services, Policy, and Practice, Brown University School of Public Health

Chris contributed to the RAND 2.0 study and took over as lead researcher for the RAND 3.0, RAND 4.0, and PT5 (RAND 5.0) studies. His research focuses on how information and financial incentives influence patient’s choice of providers, how providers respond to changes in consumer incentives, and insurance benefit design innovations. His research has been published in leading clinical, health policy, and economics journals, including Health Affairs, JAMA, the Journal of Health Economics, and the New England Journal of Medicine.

2017 – 2024

All Price Transparency Studies

See results and analysis for each of the Employer Price Transparency Studies, covering prices from 2013 to present. Each study is available, free of charge and in its entirety.

PT5.1 (RAND 5.1)

Updated Dec 2024

A study of hospital prices from hospitals and ambulatory surgery centers from across the nation plus price variability among physician administered medications, conducted by RAND.

RAND 4.0

Published May 2022

A study of hospital prices from more than 4,000 hospitals and 4,000 ambulatory surgical care centers from across the nation, conducted by RAND.

RAND 3.0

Published September 2020

A nationwide price study of more than 3,000 hospitals using employer claims, conducted by RAND.

RAND 2.0

Published May 2019

A study of more than $13 billion in hospital spending in 25 states, conducted by RAND.

RAND 1.0 (PILOT)

Published September 2017

The first Employer Price Transparency study, focused on providers in Indiana and conducted by RAND.